At Deco Mortgage, every decision is made with one objective in mind – to provide the best possible mortgage experience for our clients. In a service driven business, we aim to transcend the industry standard by being better, not just different.

We believe in transparency, open communication, and trust, which are the core values that our company is built upon. Our carefully selected loan officers are highly trained and experienced to serve as your personal mortgage concierge from start to finish. We invite you to experience the Deco Difference.

Today's Rates

Conventional loans: 30-year and 15-year terms are offered on your primary residence with a home value of $600,000, a down payment of $120,000, 80% LTV, credit score of 780, in Florida. VA loans: 30-year term option with a home value of $600,000, no down payment, 100% LTV, credit score of 780, in Florida. VA loans: 15-year term option with a home value of $600,000, no down payment, 100% LTV, credit score of 780, in Florida Payment does not include taxes and insurance premiums. Your actual payment will be higher. Some state and county maximum loan amount restrictions may apply. We don’t yet have your complete financial picture. These figures are for estimation purposes only and may not reflect the exact terms of your loan. Your actual rate and payment could be higher. Get an official Loan Estimate before choosing a loan. Loan approval is subject to underwriter review: not everyone who applies will be approved. The credit score assumption in these scenarios is 780 and you will have an escrow account for payment of taxes and insurance. Based on market conditions these rates are subject to change. This is not a commitment to lend.

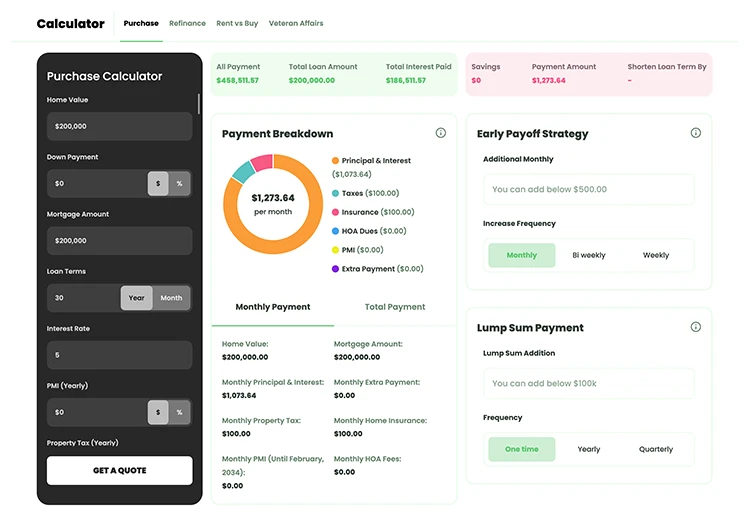

Use our mortgage calculator to see some loan scenarios

Visit our blog with 100+ articles on important mortgage topics.

Our blog articles are geared towards first-time home buyers and mortgage market news.

As an education based mortgage company we strive to provide helpful information.

Should You Buy a Home and Renovate or Buy Move-In Ready?

When it comes to buying a home, one of the big decisions many buyers face is whether to purchase a…